During the federal public health emergency for COVID-19, people could keep their Medicaid coverage longer than normal. The continuous Medicaid coverage requirement helped millions of people continue to access the healthcare they needed during the pandemic.

That requirement ended on March 31, 2023, and nearly 25 million people had been disenrolled from Medicaid as if July 2024. 1

If your coverage was continued under Medicaid because of the public health emergency, you may have since lost coverage if you no longer qualify. But even if you still qualify for Medicaid, you may need to take steps to verify your eligibility.

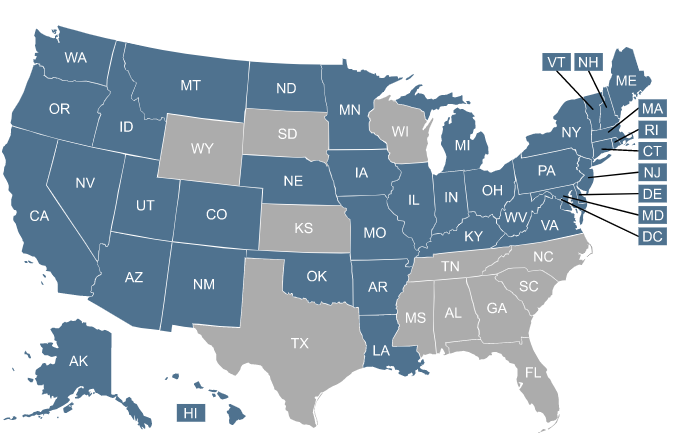

Unwinding of continuous Medicaid coverage has been handled differently in each state. Click your state below to find state-specific information.

| Expansion states |

| States refusing |

(NOTE: The unwinding of continuous Medicaid coverage does not impact the Supplemental Nutrition Assistance Program (SNAP), although the additional pandemic-related SNAP benefits ended in February 2023. And the end of the federal public health emergency on May 11, 2023, will affected SNAP eligibility for some people. Watch for letters and notices from your state to stay up-to-date on what you need to know about SNAP.)

Losing Medicaid will make you eligible for a special enrollment period in the Affordable Care Act (ACA) Marketplace. An estimated 2.7 million Americans who are disenrolled are expected to qualify for financial help in the form of premium subsidies, which lower the cost of a health plan in the Marketplace.

Of those expected to lose Medicaid coverage, an estimated 5 million are expected to gain other coverage – primarily through employer-sponsored plans. If you have access to an employer’s health plan, you will qualify for a special enrollment window to sign up for the plan. This could be through your employer or the employer of a parent or spouse. But don’t delay. Employer enrollment periods are typically limited to 60 days in cases where the applicant has lost Medicaid coverage.

If your employer-sponsored coverage option seems unaffordable, you may qualify for help paying for health insurance through the Marketplace. Use our Employer Health Plan Affordability Calculator to see your potential savings.

Medicare is a federal health insurance program for people aged 65 and older. It also covers people younger than 65 who have permanent disabilities, including those diagnosed with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS).

Medicaid redetermination – sometimes called Medicaid renewal – is the process states use to confirm people still qualify for Medicaid. Medicaid eligibility is based on financial and other criteria, and redetermination helps ensure people meet the criteria.

Medicaid redeterminations were put on hold for three years during the public health emergency to help ensure ongoing access to healthcare services.

Starting in early-mid 2023, states returned to normal processes to check Medicaid eligibility and update their Medicaid rolls. If you are enrolled in Medicaid, you will need to go through your state’s renewal process at least once a year going forward. In many cases, this process can be completed automatically (ex parte). But if the state doesn’t have enough information on file to determine whether you’re still eligible, you’ll need to complete renewal paperwork in order to prove that you’re still eligible.

Medicaid disenrollments could resume as early as April 1, 2023, but most states waited until the end of April, May, or June to start disenrolling people.

Initially, the plan was for states to initiate eligibility redeterminations for their entire Medicaid population during a 12-month period that began in early 2023. But that window has been extended in many states and is expected to last throughout much of 2024. 2

Your coverage will likely continue until your renewal date, although states can disenroll a person when they receive notice of a change in circumstances that makes the person ineligible, even if they’re not yet due for renewal.

Once your renewal is processed, your coverage will only continue if the state determines that you’re still eligible for Medicaid. If not, you’ll be disenrolled.

If you lose Medicaid and you’re not eligible for an employer’s health plan, you’ll be able to enroll in a Marketplace/exchange plan to replace your Medicaid coverage. In states that use HealthCare.gov, there’s an extended special enrollment period, through November 30, 2024, for people who lose Medicaid at any point during the “unwinding” of the pandemic-era continuous coverage rule. 2